How Medical Debt Impacts The Credit Market: Would Value-Based Care Provide Relief?

Most will agree, our healthcare system is in chaos. The problem is systemic and far-reaching. Costs are rising, patients are confused—and the quality of care isn’t where it needs to be. Those on the receiving end of care (patients), those who provide care (doctors and hospitals), and those who pay for it (insurance companies and employers) understand. They’re on the front lines when it comes to a healthcare system that charges for services rendered instead of rewarding positive outcomes.

Yet, another group is feeling the fee-for-service pinch as well: Consumers in the credit market. Every day people looking to buy a home, finance a car, or take out a student loan are feeling the impact of a healthcare market that isn’t delivering value.

Fortunately, that situation is changing. Starting in the first half of 2023, credit-reporting agencies Equifax, Experian, and TransUnion will no longer include medical debt in collections under $500 on credit reports. And they’ll wait one year (rather than six months as has been the practice since 2017) before including unpaid medical debt greater than $500 on credit reports, giving consumers more time to pay, before credit is impacted.

Unpaid Medical Bills Damage Credit Scores

So what does credit have to do with healthcare? For consumers, medical debt and medical collections work against them

When Americans incur healthcare costs that they cannot pay, the debt goes into collections. This debt activity in turn shows up on credit reports. The fallout? These consumers get dinged the next time they apply for the credit they need. Hard-working people experience stress around unpaid medical bills that are disproportionate to outcomes achieved. They become part of a downward financial spiral that impacts their quality of life and borrowing power. This can lead to a long, difficult road from which to recover.

About nine percent of Americans (23 million people) have medical debt, according to a recent analysis by the Kaiser Family Foundation. While about 92% of Americans have health insurance, according to a recent article published by Statista, it doesn’t always take care of all the bills. Three million people have more than $10,000 in unpaid medical bills—a fact that most likely impacts their credit scores, despite the reality that medical debts and collections are proven not to be predictive of a consumer’s creditworthiness.

Individuals and families whose credit scores are affected by unanticipated medical charges are often those historically marginalized, including lower-to-middle-income Americans and minority groups.

VantageScore Reduces Impact of Medical Debt on Credit Scores

According to Silvio Tavares, President and CEO of VantageScore, a credit-scoring organization founded in 2014 by Equifax, Experian, and TransUnion, medical debt is different from most other kinds of debt. It often arises from unforeseen circumstances—as its occurrence is not planned or anticipated. Tavares notes that complicated, opaque insurance and healthcare billing practices only compound the issue. Our status quo healthcare system does not give its constituents the means to understand or predict how much care will cost so it can be planned for.

This situation sheds light on yet another way the prevailing fee-for-service healthcare payment model is failing the very people it is supposed to help. It is a flawed model because it pays only on the number of services performed—not on how well a patient fares. Because of all these factors, VantageScore made the decision to no longer factor in medical debt and medical collection data when calculating credit scores. Enlace Health commends those not directly involved in the healthcare marketplace—such as VantageScore and the three major reporting companies—for doing their part to minimize the impact of unproductive practices related to current payment models and billing practices in healthcare today.

Our decision to remove this information entirely is reflective of VantageScore’s continued effort to be the most predictive model and increase financial inclusion. "

Value-Based Care Reducing Cost of Healthcare

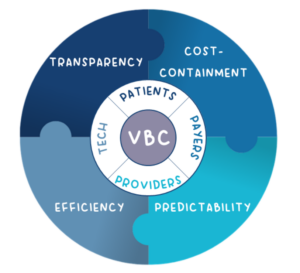

The price of healthcare continues to rise — currently sitting at 19.7% of the United States GDP. Patient outcomes take a backseat to the day-to-day operations of healthcare. And consumers feel the impact financially in more ways than one. Luckily, changes are coming. Value-based care lets all involved—payers, providers, tech companies, patients, plus credit scoring and reporting organizations—engage within an ecosystem of efficiency, cost-containment, transparency, and predictability.

References:

Making The Case for Value-Based Care: BCBS Execs Speak Out

How to Increase Savings with Value-Based Care

VantageScore Takes Steps to Further Support Consumers Affected By Medical Debt Collections

VantageScore Excluding Medical Bills from Credit Scores

ASK ENLACE

ASK ENLACE